Budget needs bold reforms in banking, revenue to weather economic risks: CPD

The Center for Policy Dialogue (CPD) has recommended a budget for the next fiscal year that emphasises economic recovery and stability by tackling macroeconomic challenges and risks.

"As the global economic situation is improving and global commodity prices are cooling down, there is hardly any room to blame the global volatility for the ongoing challenges confronting the Bangladesh economy," said CPD Executive Director Dr Fahmida Khatun while presenting the organisation's review of Bangladesh's situation and recommendations for the budget of the fiscal 2023-24 at the CPD office in the capital on Monday.

Suggesting a budget that can weather "storms and risks" in the macroeconomic environment, Fahmida Khatun said, "The weakness within the economy has become apparent and the Ukraine war should no longer be used as an excuse for everything. A lack of internal governance and reforms has weakened the economy."

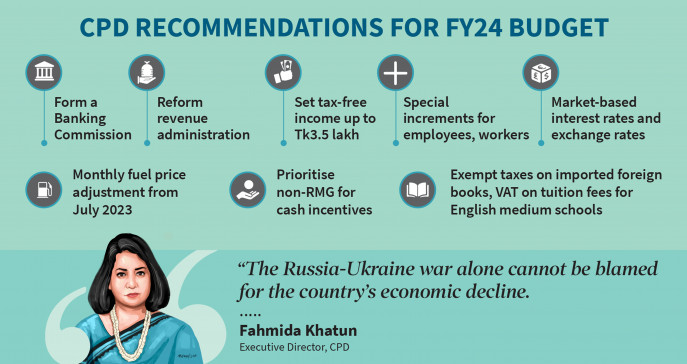

In order to recover the economy and restore stability to the macroeconomy, she said, the government has to take bold steps like the formation of a Banking Commission and reform of the revenue sector in the next budget.

She, however, expressed doubts about how many steps the government will be able to take in the budget of the election year.

Stating that the socioeconomic indicators of the country have become very weak, Fahmida said revenue collection in the first six months of the current financial year is not at all comforting. Around Tk75,000 crore shortfall in revenue collection may occur in the current fiscal year.

If the CPD's forecast is correct and to meet the conditions of the IMF, a 27% growth in revenue collection will be required for the next financial year, said the CPD executive director.

"The implementation of the Annual Development Programme (ADP) has also not reached the expected level. The government is restricting the import of certain goods to save foreign currency. Hence, it will be very difficult to meet the revenue growth target," she said.

Fahmida Khatun said net foreign financing has declined and the government borrowing heavily from the banking system, particularly from the central bank. Many banks are unable to lend due to a liquidity crunch. Currency circulation outside the bank is increasing. But people's purchasing power is decreasing. A picture of uncertainty is emerging in the market.

"Looking at the indicators, it can be understood that the overall activity of the economy has slowed down. Although the government has taken various administrative initiatives, it has not yielded results. If such a situation continues, we may fall short in meeting the conditions of the IMF's $4.7 billion loan," she said, adding that it is still possible to manage the economic downturn by establishing good governance and order.

"The problems that started in the country's economy due to the increase in the price of goods in the global market after the Ukraine war broke out have now amplified. The next fiscal budget can be the main weapon to address these problems," she said, putting forward a set of recommendations for the budget formulation.

Special Increment for public and private employees

Research Director of CPD Golam Moazzem said it is necessary to give a special increment to all the officials and employees working in the public and private sectors to relieve the people of limited income from the effects of inflation.

Fahmida Khatun, executive director of CDP, said prices of daily essentials have increased by more than 25%, which is not apparent in the average inflation data published by the government.

"At present, a family of four members in Dhaka city has a monthly food expenditure of Tk7,131 without fish and meat (compromise diet) and the cost with fish and meat will stand at Tk22,664," she said.

In this context, Fahmida recommended giving a 5% increment in the wages of workers of various industries, as well as forming a new wage structure for them. Apart from food aid, the CPD recommended cash incentives for the poor.

The CPD highlighted the difference in domestic and international prices of four items — rice, soybean oil, sugar and beef — and concluded that the inflation prevailing in Bangladesh now may not necessarily be imported inflation, as is commonly presumed. Rather, inflation in Bangladesh appears to be a largely domestic phenomenon.

Proposing to set the tax-free income limit at Tk3.5 lakh in the next budget, the CPD said the next slab for personal income tax, which is 5% for an additional Tk1 lakh, should be increased to Tk3 lakh to provide a cushion for the middle-income earners.

Proposing to increase the tax rate at the highest slab for personal income tax from 25% to 30%, the CPD said in FY23 the rate of investment tax rebate was fixed at 15% on the eligible amount. This means top earners receive higher tax rebate benefits and CPD proposes to withdraw the provision.

Reduce subsidy in energy sector

The CPD has recommended a reduction in subsidies on electricity and fuel in the next financial year's budget. According to the organisation, it is necessary to adjust the price of fuel oil with the international market from next July and it should be adjusted once every month.

Research Director Golam Moazzem said the government's subsidy in the power sector has to be paid because of overcapacity. Capacity charges have to be paid even without consuming electricity, which the government sees as a subsidy. In this situation, he recommended going for a "no electricity, no pay" method.

Criticising the government for not adjusting the price of fuel oil accordingly despite the decrease in the price in the global market, Golam Moazzem said the Bangladesh Petroleum Corporation (BPC) is now making a profit on fuel oil, which is not expected at all.

Fearing more subsidies in gas as the import of LNG began at the international market rate, he said budget allocation should be provided on a priority basis for domestic gas exploration. Promoting clean energy could ultimately help the power and energy sector out of the subsidy burden.

The CPD said a major overhaul in the structure of cash incentives for the export sector is needed, targeting the future outlook of the country's exports. In view of promoting export diversification, FY24 may consider shifting a portion of RMG cash incentives to non-RMG products that have higher export potential.

To increase remittance, the CPD proposed to introduce a market-based exchange rate. The organisation said, at present, the exchange rate against USD is Tk113, while the remittance rate is Tk107. Such a measure would reduce the demand for cash incentives (currently 2.5%) for inward remittance.

The CPD said the fertiliser subsidy must be continued in FY24 to ensure that food production gets the utmost priority in a time of uncertainty over the global food supply.

Need more allocation for Health

The CPD proposed to increase the budget allocation and its utilisation in the health sector. It also proposed to implement a number of fiscal measures to promote public health and in turn maximise welfare for society.

Bangladesh's budget allocation for the health sector has been less than 1% of the GDP. On the contrary, in 2017, at least 30 least-developed countries (LDCs) spent more than 1% of GDP on health.

The CPD recommended that the VAT on medicines should be exempted starting from FY26 to ensure that medicines continue to be affordable to all even after the loss of the TRIPS waiver in 2026.

The CPD proposed to impose a specific excise duty on tobacco products — Tk10 per stick of cigarettes, Tk3 per stick of Bidi and Tk6 per gram of Jarda and Gul.

The organisation proposed to increase Health Development Surcharge from 1% to 5% and the VAT on cigarettes and other tobacco products to be increased from 15% to 20% in FY24.

The CPD proposed to increase the corporate tax on all companies manufacturing tobacco products from 45% to 50% in FY24.

For soft drinks and energy drinks, CPD recommends that the government should put a specific excise duty of Tk0.10 per millilitre or Tk100 per litre.

VAT on English medium schools should be exempted

The CPD proposed the withdrawal of VAT on tuition fees for English medium schools in FY24, saying the existing VAT puts an additional burden on the parents of middle-income households.

English Medium Schools follow the international curriculum and their students are assigned to read imported foreign books. At present, the total tax incidence on imported books is 73.96%.

"This puts further strain on families from middle-income households and impedes the efforts made in order to achieve the sustainable development goal (SDG) four, which aims for inclusive and quality education for all. Therefore, all taxes on imported foreign books should also be exempted in FY24," said CPD Executive Director Fahmida Khatun.

The allocation for education in the budget has decreased from 14% in FY10 to 11.7% in FY23 and the budget utilisation has been decreasing over the years. Therefore, it is necessary to not only increase the budget allocation and utilisation but also to undertake a variety of fiscal policies to encourage better education, Fahmida Khatun added.

Keep updated, follow The Business Standard's Google news channel

Keep updated, follow The Business Standard's Google news channel